Introduction: The “Growth Trap”

Alex is feeling good — at least on paper. After fixing his margins, his business looks profitable, yet his cash flow tells a very different story.

After reading our previous guide on Contribution Margin, Alex audited PolyCraft’s entire catalog. He cut his “Zombie” products (high ad spend, low real margin) and doubled down on his profitable “Star” products.

The results were immediate.

His P&L (Profit & Loss) statement shows his best month ever. Revenue is up. Net Profit is bright green. His accountant even sends a congratulatory email:

“Great quarter, Alex!”

But when Alex tries to place a large filament order for the Q4 rush, he hits a wall. His bank account is almost empty.

This is where the Cash Conversion Cycle (CCC) quietly takes control.

“Wait,” Alex panics. “My accountant says I made $5,000 in profit this month. Where is it?”

Nothing was stolen.

Alex has fallen into the Growth Trap — the dangerous illusion that profit and cash flow are the same thing. They are not.

- Profit is an opinion (a number on an accounting report).

- Cash is a fact (the fuel in your tank).

Alex’s profit is real, but it’s trapped. It’s sitting in cardboard boxes on his shelves (inventory) or being held hostage by Amazon’s payout cycle (receivables).

And this is how profitable businesses run out of cash.

In this guide, you’ll learn how the Cash Conversion Cycle determines whether your business lives or dies — and how Jeff Bezos used a negative CCC to scale Amazon using other people’s money.

Table of Contents

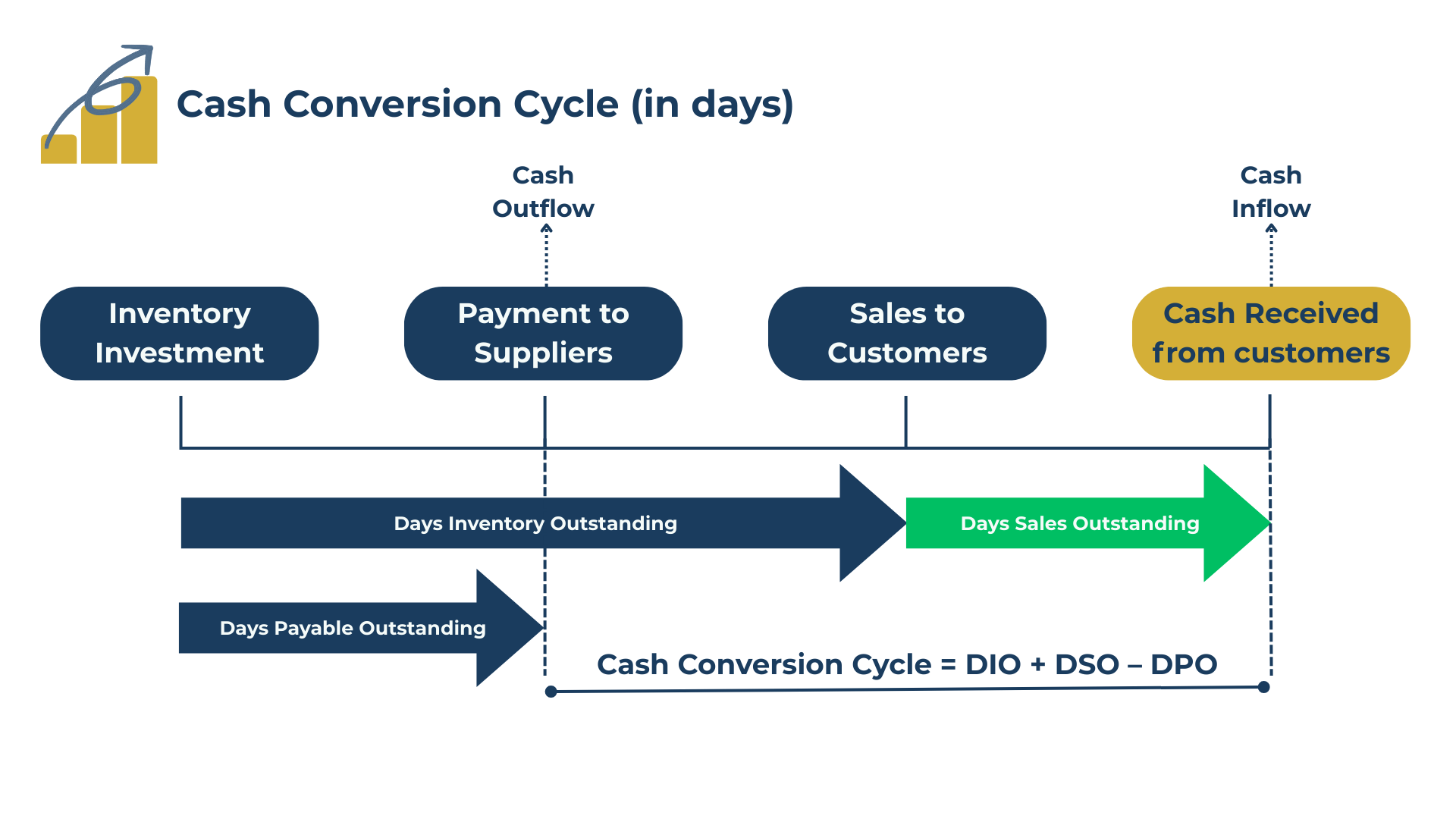

What Is the Cash Conversion Cycle?

The Cash Conversion Cycle (CCC) measures one simple but brutal truth:

How long does your cash stay trapped inside your business before it comes back to you?

Think of CCC as a financial stopwatch.

- It starts the moment cash leaves your bank account to buy inventory or raw materials.

- It stops the moment customer money actually hits your bank account.

The time in between is where most businesses quietly die.

Because during this period, your business must survive on cash flow, not profit.

Alex didn’t realize this at first. From an accounting perspective, everything looked healthy. He sold products, generated revenue, and booked profit. But operationally, his cash was locked in three places:

- Products waiting to be sold

- Orders already shipped but not yet paid out

- Supplier bills waiting to be paid

The longer cash stays trapped in this loop, the more dangerous growth becomes.

This is why fast-growing businesses often fail right after they “become profitable.” Every new order demands cash before previous sales return it.

The Cash Conversion Cycle puts a number on this risk.

- A long CCC means your business must constantly inject new cash just to keep operating.

- A short CCC means growth is easier to finance.

- A negative CCC means something extraordinary is happening — your customers are funding your growth before you pay your suppliers.

This is exactly the system Jeff Bezos engineered at Amazon.

And it all comes down to three moving parts.

And it all comes down to three moving parts that you can calculate right now.

The Formula: The Three Engines of Cash Flow

You don’t need a finance degree to understand cash flow risk.

You just need to understand the three engines that power the Cash Conversion Cycle (CCC).

In finance, these engines are called DIO, DSO, and DPO.

In plain English, they describe how long your cash is stuck, waiting, or working for you.

DIO (Days Inventory Outstanding) — The “Dust”

What it measures:

How many days your product sits on a shelf before it sells.

Alex’s reality:

Alex prints 100 dragons in advance. On average, they sit in his garage for 45 days before shipping.

Cash status:

Trapped in plastic.

Inventory feels productive — printers are running, shelves are full —

but until a product sells, cash flow is frozen.

DSO (Days Sales Outstanding) — The “Wait”

What it measures:

How many days pass between the sale and the money hitting your bank account.

Alex’s reality:

Amazon holds his funds for 14 days before paying out.

Cash status:

Trapped in Amazon’s bank account.

The sale is complete. The customer is happy.

But for Alex, the cash is still missing.

DPO (Days Payable Outstanding) — The “Leverage”

What it measures:

How long you wait before paying your suppliers.

Alex’s reality:

He pays his filament supplier immediately to get a small discount.

That means 0 days of leverage.

Cash status:

Gone instantly.

This is the only part of the cash conversion cycle that works in your favor —

and the one most small businesses completely ignore.

The Cash Conversion Cycle Formula (Simplified)

Now we connect the dots.

In plain English:

+(Days cash sits in inventory)

+ (Days waiting for payout

– (Days you delay paying suppliers)= Your Cash Conversion Cycle

Alex’s Diagnosis (Why Growth Feels Broken)

Let’s plug in Alex’s numbers:

- DIO: 45 days

- DSO: 14 days

- DPO: 0 days

45+14−0=59 days

Diagnosis:

Alex’s Cash Conversion Cycle is 59 days.

This means every dollar Alex spends is gone for two full months before it comes back.

If he wants to grow, he must personally finance that 59-day gap.

Eventually, his savings run out — even though the business is “profitable.”

This is how profitable businesses run out of cash.

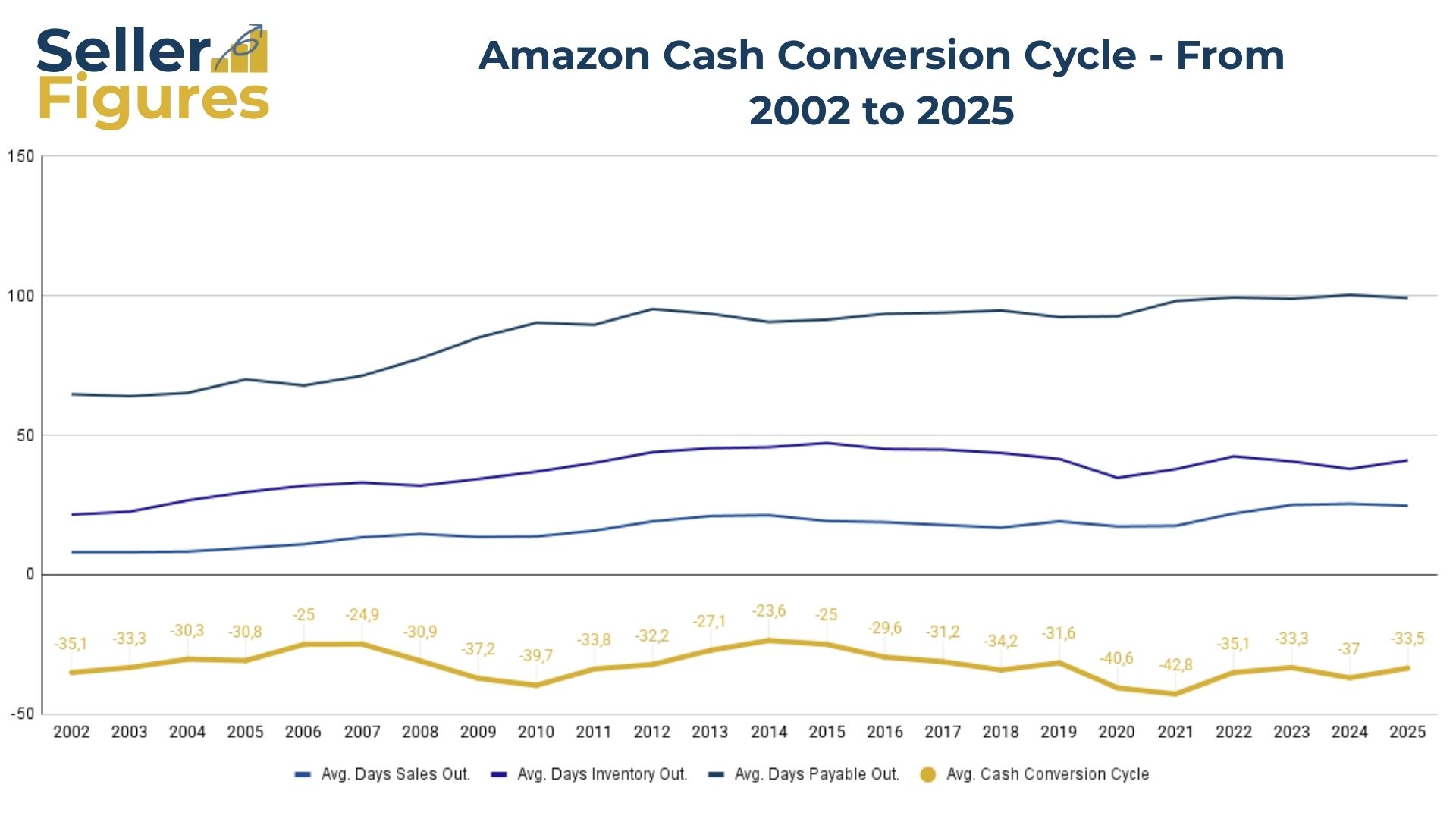

The Bezos Playbook: How a Negative Cash Conversion Cycle Works

Now let’s look at how the masters play the cash flow game.

While Alex is suffocating under a 59-day Cash Conversion Cycle, Amazon operates in a completely different financial reality. Jeff Bezos built a trillion-dollar empire by deliberately flipping the Cash Conversion Cycle (CCC) into the negative.

This is not a loophole. Amazon’s ability to operate with a negative cash conversion cycle is not a myth. According to its public financial filings, the company consistently collects cash from customers long before paying suppliers.

It is a system.

How Amazon Engineers a Negative Cash Conversion Cycle

Here’s what the cash conversion cycle formula looks like for Amazon (simplified but directionally accurate):

Low Inventory Time (DIO)

Amazon turns inventory quickly, often in ~30 days or less, thanks to demand forecasting, scale, and fulfillment efficiency.

Instant Cash Collection (DSO)

Customers pay at checkout.

Amazon receives the cash immediately.

DSO = 0 days.

Extreme Supplier Leverage (DPO)

Amazon negotiates long payment terms with suppliers — commonly 60 days or more.

The Amazon Math (Why It Changes Everything)

Let’s run the formula:

CCC=30(DIO)+0(DSO)−60(DPO)=-30 days

What a Negative Cash Conversion Cycle Actually Means

A -30 day Cash Conversion Cycle means this:

Amazon collects cash from the customer 30 days before it has to pay the supplier for the product.

This is the holy grail of cash flow management.

- Alex uses his own cash to fund growth.

- Amazon uses its suppliers’ cash to fund growth.

Every sale creates surplus liquidity.

That liquidity fuels warehouses, Prime Video, logistics, and price wars — without draining Amazon’s own balance sheet.

This is how Amazon scales aggressively without cash flow stress.

The Key Insight (And Why This Matters to You)

Amazon didn’t win because it had better products.

It won because it mastered the timing of cash.

You may not have Amazon’s scale — but the logic of the Cash Conversion Cycle still applies.

You don’t need a negative 30-day cycle.

You just need a shorter cycle than your competitors.

And that is exactly where Alex — and your business — can steal the playbook.

Case Study: Cash Conversion Cycle in Action (Alex’s Nightmare vs. The Fix)

Let’s apply the Cash Conversion Cycle (CCC) formula to PolyCraft and see how Alex moves from being cash poor to becoming cash rich—without increasing sales or raising prices.

Scenario A — The Nightmare (A Long Cash Conversion Cycle)

This is how Alex — like most small business owners — was running his business before understanding cash flow mechanics.

- Supplier Payments (DPO):

Alex pays his filament supplier upfront to secure a small 5% discount.

(Days Payable Outstanding = 0) - Inventory Management (DIO):

He prints 100 dragons “just in case” to keep the machines busy.

On average, they sit in his garage for 45 days before selling.

(Days Inventory Outstanding = 45) - Customer Payouts (DSO):

Alex relies entirely on Amazon, which holds his money for 14 days before payout.

(Days Sales Outstanding = 14)

The Cash Conversion Cycle Calculation:

45 (Inventory)

+14 (Receivables)

−0 (Payables)

=59 Days

The Reality:

Alex has a 59-day Cash Conversion Cycle.

This means that for every dollar Alex spends, he doesn’t see that cash return for nearly two full months.

During those 59 days:

- Alex is financing his inventory

- Alex is financing Amazon’s payout delay

- Alex is financing his own growth with personal savings

As sales grow, the cash gap widens. Eventually, the savings run out — even though the business looks profitable on paper.

Scenario B — The Fix (A Negative Cash Conversion Cycle)

Alex decides to stop acting like a bank and start acting like a CFO. He makes three strategic changes that directly improve cash flow.

- He Negotiates Payment Terms (DPO):

Instead of asking for a discount, Alex asks for time.

His supplier agrees to Net 30 payment terms.

(Days Payable Outstanding = 30) - He Optimizes Inventory (DIO):

Alex stops hoarding stock and switches to a Just-in-Time approach.

He keeps only 20 days of inventory for his best-selling products.

(Days Inventory Outstanding = 20) - He Accelerates Cash Collection (DSO):

Through email marketing, Alex pushes repeat customers to his own Shopify store.

Stripe pays him in 2 days instead of Amazon’s 14.

(Days Sales Outstanding = 2)

The New Cash Conversion Cycle Calculation:20 (Inventory)+2 (Receivables)−30 (Payables)=−8 Days

The Reality:

Alex has achieved a negative Cash Conversion Cycle of –8 days.

He now collects cash from customers 8 days before he has to pay his supplier.

- His bank balance stays healthy

- He can restock without stress

- Growth no longer drains cash — it generates it

Alex doesn’t need Amazon’s famous –30 days.

A negative CCC, even a small one, is enough to make growth self-funding.

Action Plan: How to Fix Your Cash Conversion Cycle (The 3 CFO Levers)

You cannot control inflation, interest rates, or Amazon’s payout policies.

But you can control three numbers inside your business.

If you want to escape the cash flow trap, you need to actively manage your Cash Conversion Cycle (CCC).

That means pulling three specific levers—the same ones Amazon mastered, just at a small business scale.

Think of this as your CFO checklist.

Lever #1: Extend Payables (Increase DPO)

This is the most powerful lever for small businesses—and the most underused.

The Problem

Alex was paying his supplier upfront (Day 0) just to secure a small 5% discount.

On paper, that looks smart. In reality, it destroys cash flow.

The Fix

Cash flow beats margin.

Alex stops optimizing for tiny discounts and starts optimizing for survival and growth.

He negotiates Net 30 payment terms, agreeing to pay the full price—but 30 days after shipment.

This single move immediately improves his Cash Conversion Cycle by 30 days.

Supplier Negotiation Script (Copy & Paste)

“Hi [Supplier Name], my business is growing 20% month-over-month.

To sustain this volume and increase my order size with you, I need better cash flow alignment.

I’d like to move our account to Net 30 terms starting with the next purchase order.

This will allow me to place larger and more frequent orders with you.”

CFO Insight:

If a supplier refuses Net 30, they are telling you one thing clearly: they don’t believe you’ll grow.

That’s valuable information.

Lever #2: Shrink Inventory (Decrease DIO)

The Problem

Alex printed 100 dragons “just in case.”

They sat in his garage for weeks, turning cash into plastic.

Inventory felt productive.

In reality, it was idle capital.

The Fix

Alex stops hoarding and starts managing inventory like a CFO.

He applies ABC Inventory Analysis:

- A-Items (Best Sellers): Keep ~20 days of stock

- B-Items: Limited buffer

- C-Items (Slow Movers): No stock. Print or order only after the sale

CFO Rule

Inventory is not an asset.

It is cash in a coma.

Your job is to wake it up.

Lower DIO = less cash trapped = faster growth without external funding.

Lever #3: Accelerate Receivables (Decrease DSO)

The Problem

Amazon holds Alex’s money for 14 days after each sale.

That delay forces him to finance operations with his own savings.

The Fix: Get Paid Faster

You have two realistic options:

Option A: The Amazon Cash Flow Hack

Use third-party payout accelerators (e.g., Payability).

- Daily or near-instant payouts

- Cost: ~1–2% fee

- Best for sellers scaling fast and needing liquidity

Option B: The Strategic Shift (Long-Term Play)

Diversify sales channels.

Alex moves his loyal customers to his own Shopify store via email marketing and bundles.

- Stripe / PayPal payouts: 24–48 hours

- Lower dependency on Amazon

- You own the customer relationship

CFO Insight:

Amazon optimizes for their cash flow—not yours.

You need at least one channel that works in your favor.

Conclusion: Profit Is Vanity, Cash Is Sanity

Congratulations.

You’ve now mastered the two pillars of financial survival:

- Contribution Margin tells you if you’re making money

- Cash Conversion Cycle tells you when you can use it

By fixing his CCC, Alex didn’t raise prices.

He didn’t cut ads.

He didn’t take a loan.

He simply unlocked cash that was already his, trapped in inventory, receivables, and bad payment terms.

Now his bank account is full.

Restocking is stress-free.

Growth funds itself.

But this creates a new, better problem.

Now that Alex has cash, where should he deploy it?

- Back into the Amazon machine—where fees are high and ownership is zero?

- Or into building a Direct-to-Consumer fortress, where margins compound and customers belong to him?

That decision defines the next stage of the business.

The Cash Conversion Cycle is just one piece of the puzzle.

If you want to understand how profitable Amazon sellers actually build a scalable business, from product economics to cash flow to long-term strategy, this guide is part of a bigger system.

👉 Read the complete Seller Financial Playbook.

Want a Second Set of Eyes on Your Numbers?

If you’re not sure which of your products are stars — and which ones are quietly bleeding cash — that’s normal. Most standard reports don’t show this clearly.

Auditing your products using Contribution Margin

Or building a simple, decision-ready profitability model for your business

Identifying cash-draining SKUs