Introduction: The Profit Paradox

Contribution Margin vs Gross Margin.

Most small business owners don’t realize how dangerous this difference is—until their bank account runs dry.

Meet Alex.

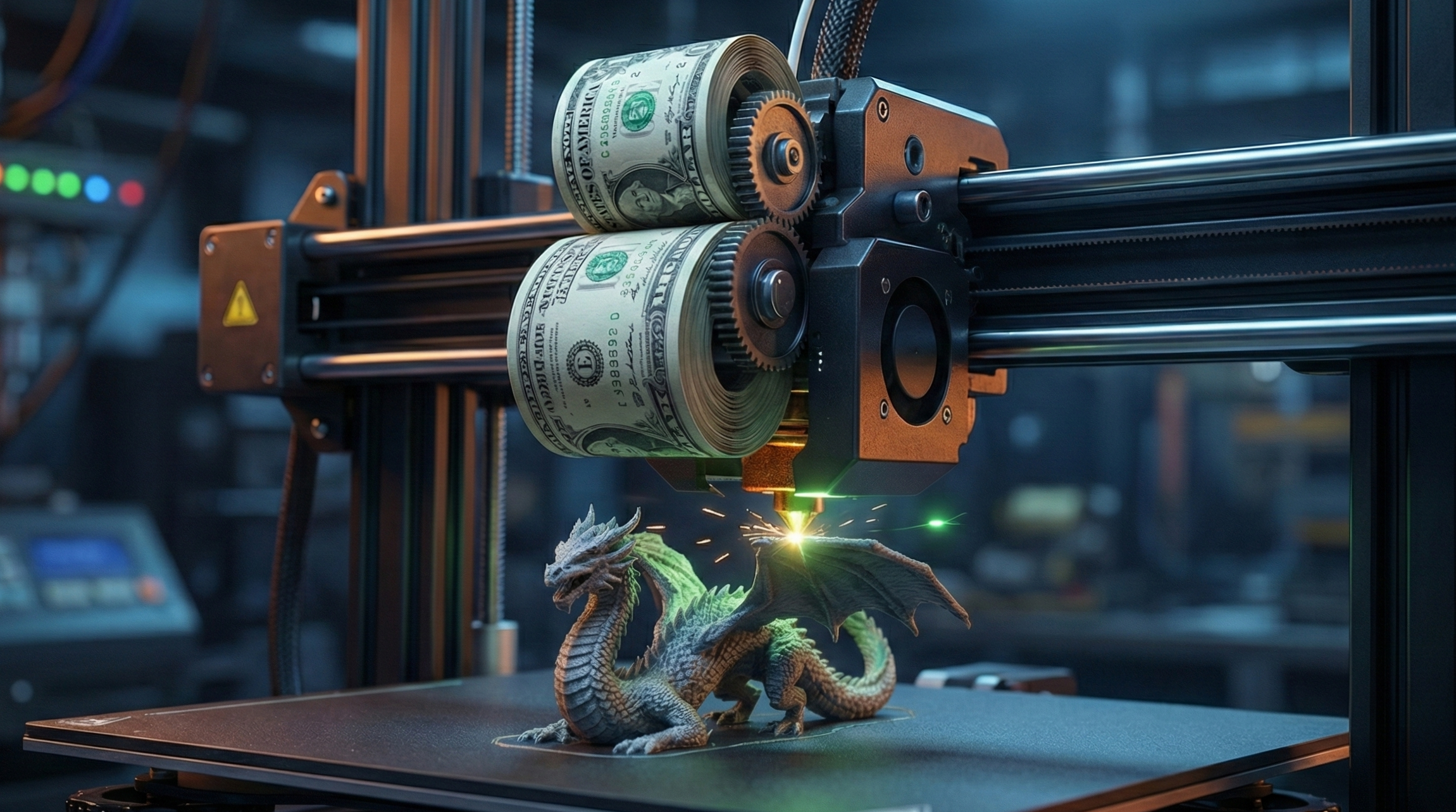

He runs PolyCraft, a growing 3D print farm with twenty machines running almost 24/7 in his garage. His best-selling articulated dragons perform well both on Shopify and Amazon.

On the surface, Alex is doing everything right.

Sales are up. Orders keep coming in. According to his reports, his gross margin looks healthy—around 65%. Each dragon sells for $40, and the filament costs only $8. On paper, the math looks perfect.

But at the end of the month, when Alex logs into his bank account to pay himself, something feels very wrong.

There’s no money left.

“How can this be?” he asks.

“My gross margin is strong. Revenue is growing. Where is the cash?”

This is the “Profit Paradox” that kills thousands of small businesses every year—and it usually starts with a misunderstanding of contribution margin vs gross margin. This paradox is one of the core strategic mistakes we break down in our 2026 Financial Blueprint for Small Businesses, where we outline the five financial moves founders must master to stay profitable in a tougher market

The issue isn’t Alex’s product.

It isn’t demand.

And it isn’t even pricing—at least not directly.

The real problem is that Alex is running his business based on gross margin, while ignoring contribution margin—the one metric that actually shows whether each sale puts money into his pocket or slowly drains it out.

Gross margin looks good on reports.

Contribution margin tells the truth about cash.

To survive in 2026—when ad costs, fulfillment fees, and return rates keep climbing—small business owners need to stop thinking like tax accountants and start thinking like CFOs.

In this guide, we’ll use Alex’s 3D printing business to break down contribution margin vs gross margin, show how a “profitable” product can still lose money on every sale, and explain how to fix the problem before growth makes it irreversible.

Table of Contents

The Trap: Why Gross Margin Is Misleading for Small Business Owners

This is where the confusion between contribution margin vs gross margin becomes dangerous. One metric looks great on a report, while the other determines whether your business actually survives

To understand why Alex is struggling, we first need to look at the number giving him a false sense of security: Gross Margin.

When Alex’s accountant sends him a monthly P&L (Profit and Loss) statement, the calculation is simple and traditional:

Gross Margin Formula: Why the Math Looks Right (But Feels Wrong)

Gross Profit = Revenue – Cost of Goods Sold (COGS)

Gross Margin = Gross Profit / Revenue

In Alex’s case, the math for one articulated dragon looks like this:

- Selling Price: $40.00

- Filament & Electricity (COGS): –$8.00

- Gross Profit: $32.00

On paper, this is a home run.

An 80% Gross Margin suggests Alex has plenty of room to breathe. The report confidently says:

“You made $32 on this product.”

But this is where many small business owners get trapped.

Gross Margin measures potential, not reality. It calculates the profit of a product sitting safely on the shelf—before it has to do the hard work of reaching a customer.

The Hidden Costs Gross Margin Ignores

Gross Margin completely ignores the friction required to make a sale happen.

It doesn’t see:

- The Facebook or Amazon ad Alex paid to acquire the customer

- The shipping label he purchased

- The marketplace referral fee deducted instantly

- The operational costs that scale with every single order

Alex is looking at his $32 Gross Profit and thinking he has money to pay rent or buy another printer.

But he hasn’t paid the toll to the market yet.

The Solution: What Is Contribution Margin? (And Why CFOs Care About It)

If Gross Margin is the view from the accountant’s office, Contribution Margin is the view from the trenches.

This is exactly why we listed ‘Stop Chasing Revenue’ as CFO Move #3 in our strategic guide: Contribution Margin answers the most fundamental operational question in Alex’s business:

“After I pay for the customer, the platform, and the delivery, how much cash is actually left to run the business?”

Instead of stopping at COGS, Contribution Margin subtracts all variable costs—the costs that increase with every single order.

Contribution Margin Definition

Contribution Margin is the amount of money each sale contributes toward paying your fixed costs (rent, salaries, software) after all variable costs are covered.

In simple terms, it tells you:

“Does selling one more unit make me richer — or just busier?”

This is why CFOs obsess over Contribution Margin while tax accountants focus on Gross Margin. One helps you survive. The other helps you file returns.

Contribution Margin Formula (The CFO Filter)

Here’s the full formula:

Contribution Margin = Selling Price – (COGS + Ad Spend + Shipping + Transaction Fees + Returns)

This is what we’ll call the CFO Filter.

A Real-World Contribution Margin Calculation

Let’s apply this filter to Alex’s $40 articulated dragon:

- Selling Price: $40.00

- COGS: –$8.00

- Shipping (Average): –$8.50

- Ad Spend (CPA): –$14.00

- Marketplace Fee (15%): –$6.00

Contribution Margin: $3.50

Why a Positive Gross Margin Can Still Kill Your Cash Flow

Here’s the reality check.

Alex thought he had $32.00 to play with. In reality, he only has $3.50.

That $3.50 is the only money contributing to:

- His garage rent

- Software subscriptions

- Maintenance

- And his own salary

If Alex sells 100 dragons this month, he believes he generated $3,200 in profit. In truth, he only created $350 to cover his overhead.

This is why his bank account is empty.

He isn’t building wealth.

He’s simply moving money from his customers to Mark Zuckerberg (ads) and UPS (shipping).

The Silent Killers of Contribution Margin: Why Variable Costs Are Exploding

At this point, you might be thinking:

“Okay, I just need to lower my ad spend or negotiate better shipping rates.”

If only it were that simple.

The gap between Gross Profit and real profitability is widening because the real enemies of your margins—the silent killers—are your variable costs. And in 2026, these costs are inflating faster than most small businesses can raise prices.

You are not mismanaging your business.

You are swimming against a powerful macro-economic current.

Here is the data behind why Alex’s margins keep shrinking—even as sales grow.

The Explosion of Ad Costs (CPA Inflation)

In the “good old days” of 2020, cheap traffic could hide a lot of operational mistakes. Those days are gone.

According to the Singular Quarterly Report (Q4 2025), customer acquisition costs are rising sharply as competition intensifies across all major platforms. Global ad spend increased 24% quarter-over-quarter, signaling a brutal bidding environment.

The situation is even worse for e-commerce sellers:

- On iOS, Cost Per Install (a strong proxy for mobile acquisition costs) jumped 44%

- North America is now the most expensive region in the world to advertise, with CPMs hitting record highs

The takeaway:

Even if your Gross Margin stayed flat this year, a 20–25% increase in ad costs doesn’t gently compress your profits—it destroys your Contribution Margin.

Logistics & Fulfillment Creep

Shipping is no longer a stable cost—it’s a volatile commodity.

Major carriers like FedEx and UPS, along with marketplaces such as Amazon FBA, now implement annual General Rate Increases of around 5–6%. But the real damage comes from layered surcharges: fuel adjustments, delivery area fees, and peak-season penalties.

What used to cost Alex $8.00 to ship a dragon last year may quietly cost $9.50 or more today.

This slow, incremental creep rarely triggers alarms in a Gross Margin calculation.

But Contribution Margin captures it immediately—order by order.

The Hidden Cost of Returns

Returns are the most underestimated margin killer in e-commerce.

When a customer returns one of Alex’s dragons, it’s not just a canceled sale. He loses:

- The outbound shipping cost

- The return shipping cost

- Packaging and handling labor

Industry data shows e-commerce return rates hovering around 19%. At that level, one return can wipe out the profit from multiple successful sales.

Gross Margin ignores returns entirely.

Contribution Margin exposes them for what they are: cash leaks.

This is why Alex feels busier than ever—but poorer.

His prices didn’t collapse.

His product didn’t fail.

His variable costs quietly exploded.And unless you measure profitability at the Contribution Margin level, these silent killers will continue to drain your business—one order at a time.

Case Study: Two Products, Same Gross Margin — Very Different Contribution Margins

To understand exactly how this works in real life, let’s look at two specific products in Alex’s catalog.

Both products sell for $40.

Both cost $8 to produce.

On the accountant’s report, they look identical.

Each one shows a healthy $32 Gross Profit and an 80% Gross Margin.

But when Alex applies the Contribution Margin formula, a very different reality emerges.

Product A: The “Viral Dragon” (The Zombie Product)

This is Alex’s bestseller. It goes viral on TikTok, racks up thousands of likes, and looks like a massive success from the outside. To keep sales volume high, Alex runs aggressive Meta ads in a highly competitive niche.

On paper (Gross Margin):

- Selling Price: $40.00

- COGS: –$8.00

- Gross Profit: $32.00 (80%)

Looks perfect.

Now let’s apply the Silent Killers.

Real variable costs:

- Shipping: –$8.50

- Marketplace Fees (15%): –$6.00

- Ad Spend (High Competition / Creative Fatigue): –$20.00

Real Contribution Margin: –$2.50

The Reality:

Every time Alex sells this dragon, he loses $2.50.

This is a Zombie Product — a product that looks profitable on paper but quietly destroys cash in reality. It generates revenue, keeps the printers busy, and inflates dashboards, but it slowly eats the business alive.

The more Alex scales this product, the faster he burns cash.

Product B: The “Replacement Part” (The Star Product)

This product couldn’t be more different.

It’s a boring, functional replacement bracket designed for a specific niche. It never goes viral. There are no flashy ads. Customers find it through SEO, repeat purchases, or low-cost retargeting.

On paper (Gross Margin):

- Selling Price: $40.00

- COGS: –$8.00

- Gross Profit: $32.00 (80%)

Same numbers. Same gross margin.

Now apply the real costs.

Real variable costs:

- Shipping: –$8.50

- Marketplace Fees (15%): –$6.00

- Ad Spend (Organic / Retargeting): –$5.00

Real Contribution Margin: +$12.50

The Reality:

This boring product is a cash machine.

Every single sale drops $12.50 of real cash into the business — money that actually pays for rent, software, and Alex’s own salary.

The CFO’s Verdict: What the Numbers Really Say

If Alex only looks at Gross Margin, both products appear equally successful. He might even double down on Product A because it generates more sales volume.

But a CFO looking at Contribution Margin sees the truth instantly:

- Product A is a cash-draining product.

It must be fixed (higher prices, lower CPA) or shut down immediately. - Product B is the lifeline.

This is where marketing budget, SEO effort, and product expansion should go.

Gross Margin tells you what could be profitable.

Contribution Margin tells you what actually keeps your business alive.

Action Plan: How to Audit Your Products Today

You don’t need expensive software or a finance team to fix this. You can do it this afternoon with a simple spreadsheet.

Step 1: Export Your Sales Data (Last 30 Days)

Pull a report of your top 5 best-selling products by revenue or units sold.

Step 2: Add the Critical Variable Cost Columns

Next to each product, add the costs that scale with every order:

- Average CPA

(Total ad spend for that product ÷ total units sold) - Average shipping cost

(Total shipping paid ÷ total units sold) - Marketplace or payment processing fees

Step 3: Calculate Contribution Margin Per Product

Use this formula:

Selling Price – (COGS + Fees + CPA + Shipping)

Step 4: Use the Contribution Margin Decision Matrix

- Green (Positive Contribution):

These are your winners. Scale them. - Yellow (Low Contribution):

Risky products. Can you increase price, bundle them, or raise AOV to cover shipping? - Red (Negative Contribution):

These are Zombie Products. Stop advertising them immediately. Either fix the economics or kill them.

Final Thought

This article covers just one critical piece of the puzzle. In the 2026 Financial Blueprint, we connect Contribution Margin with cash flow timing, forecasting, and channel strategy — so you’re not just profitable on paper, but liquid in real life..

If there’s one idea you take away from this guide, let it be this:

Revenue is vanity. Gross Margin is comfort. Contribution Margin is survival.

Most small businesses don’t fail because they lack demand.

They fail because they scale products that look profitable but silently drain cash with every sale.

Alex didn’t have a marketing problem.

He didn’t have a product problem.

He had a measurement problem.

The moment he stopped asking “How much did I sell?” and started asking

“How much cash did this sale actually leave behind?”, everything changed.

Contribution Margin is not a theoretical finance concept.

It’s a daily operating tool that tells you:

- Which products deserve your attention

- Which products are lying to you

- And which ones are slowly putting your business at risk

You don’t need to become a CFO.

But you do need to think like one.

In the next guide, we’ll go one level deeper and answer another question most founders struggle with:

If my products are profitable, why am I still short on cash?

That’s where Cash Conversion Cycle (CCC) comes in — and why profitable businesses still run out of money.

Want a Second Set of Eyes on Your Numbers?

If you’re not sure which of your products are stars — and which ones are quietly bleeding cash — that’s normal. Most standard reports don’t show this clearly.

Auditing your products using Contribution Margin

Or building a simple, decision-ready profitability model for your business

Identifying cash-draining SKUs