Let’s be honest: the old playbook for running a small business is broken.

A few years ago, you could rely on cheap capital and aggressive ad spend to fuel growth. Revenue was the only metric that seemed to matter. Cash flow and financial planning took a back seat. But as we head into 2026, the economic tide has turned.

For e-commerce sellers and small business owners, the era of growth at all costs is officially over. We are now in the era of efficiency, liquidity, and disciplined capital management.

It’s a painful realization for many entrepreneurs to check their dashboards and see record-breaking sales—only to look at their bank accounts and wonder where the cash actually went.

This disconnect usually boils down to one thing: financial structure.

While your competitors are obsessing over top-line revenue, the real winners in 2026 will be the operators who manage their capital with a CFO’s level of precision. If you are still relying on static annual budgets, ignoring the nuances of your Cash Conversion Cycle (CCC), or failing to plan for the post-Q4 inventory hangover, you are navigating a volatile market with an outdated map.

In this guide, we move beyond generic “money-saving tips.” We build a practical financial blueprint for the year ahead. From shortening your cash cycle to leveraging AI for predictive financial modeling (not just writing emails), here are the five critical shifts you must make to protect cash flow, improve profitability, and recession-proof your business in 2026.

Table of Contents

CFO Move #1: Replace Static Budgets with Rolling Forecasts

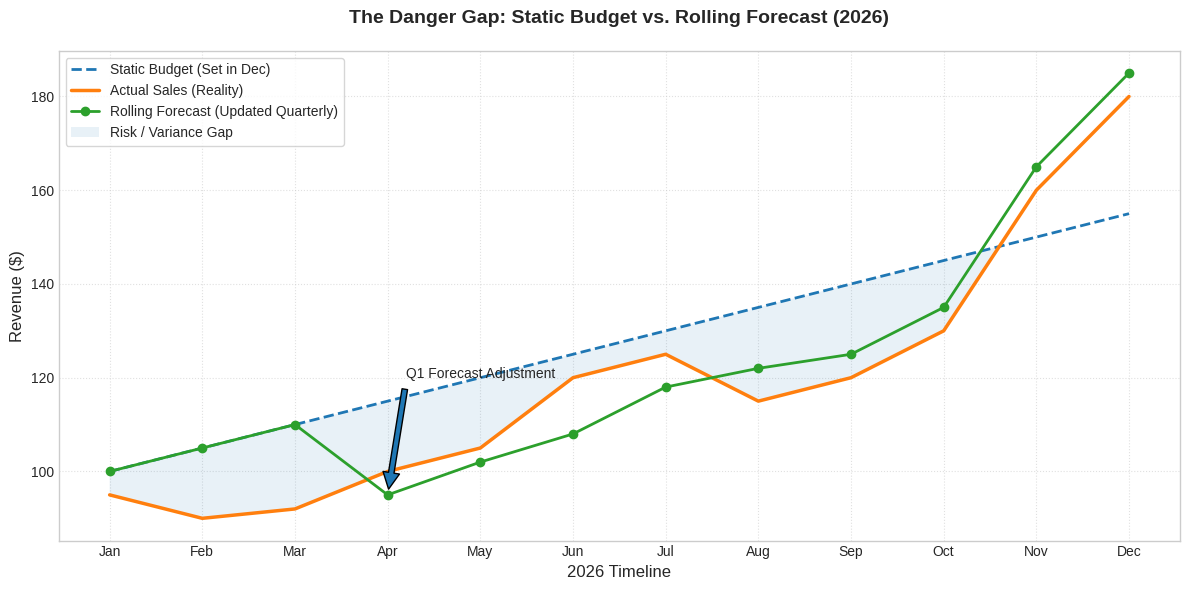

If you are still running your business on a static annual budget created in December, you are essentially driving with your eyes closed. In today’s environment, rolling forecasts are no longer optional — they are a survival tool.

In a stable economy, a static budget makes sense. You set your targets, allocate your resources, and review performance at the end of the year. But in the volatile world of e-commerce—where shipping rates can spike overnight, and consumer demand shifts weekly—a static budget becomes obsolete before the ink is even dry.

The problem with a static budget is that it creates a false sense of security. It tells you what you hoped would happen, not what is actually happening.

Why Rolling Forecasts Beat Static Budgets in Volatile Markets

Instead of relying on a rigid 12-month plan, experienced CFOs use rolling forecasts. This is a dynamic planning approach where financial projections are updated continuously—typically on a monthly or quarterly basis—using real-time data. The goal is not perfection, but adaptability.

This shift becomes especially critical in 2026.

Surviving the Post-Q4 Hangover

For most e-commerce sellers, Q1 is the most dangerous quarter of the year. Cash reserves are depleted to support Q4 inventory builds. January arrives, demand naturally slows, and liquidity is at its lowest point of the year.

If you continue to follow a static budget that allocates fixed spending levels based on “average” months, you risk burning cash precisely when you can least afford it.

Q1 is not about growth — it’s about survival, liquidity, and resetting the rules for the year ahead.

A rolling forecast forces you to recalibrate immediately after Q4 closes, before small problems turn into cash flow crises.

Scenario:

You sold less inventory than expected in December.

Static Budget Response:

“Keep spending on PPC as planned.”

→ Result: Cash flow tightens when liquidity is already low.

Rolling Forecast Response:

“Inventory levels are above target. Pause restocking. Redirect ad spend toward targeted liquidation campaigns to free up cash.”

→ Result: Cash is released before it becomes a problem.

This is the difference between reacting to cash issues and preventing them.

CFO Action: Adopt a 3+9 Rolling Forecast

Adopt a “3+9” rolling forecast model immediately.

Lock in detailed assumptions for the next three months, while keeping the following nine months flexible. Review and update your forecast on the 5th of every month.

This transforms your budget from a static wish list into a real-time decision-making system—one that reflects how your business actually operates, not how you hoped it would.

CFO Move #2: Run a Lean Tech Audit to Cut Costs and Automate What Matters

We are living in the golden age of software tools. But for many small businesses, this abundance has created a silent profit and cash flow killer known as SaaS creep.

It usually starts innocently: a $29/month design tool, $49 for project management, another $99 for analytics. Individually, these expenses seem insignificant. Fast forward to 2026, and your business is likely bleeding thousands of dollars per year on “zombie subscriptions”—tools no one on your team has logged into for months.

In a year where efficiency is king, digital clutter is a luxury you can no longer afford.

CFO Principle: Cut Waste Before Chasing Growth

Before looking for new revenue streams, plug the leaks in your existing bucket. Every dollar wasted on bloated software stacks is a dollar unavailable for inventory, marketing, or liquidity.

The Ruthless Tech Audit (Cut the Bloat)

This January, review your credit card statements line by line and classify every recurring software expense into one of three categories:

Critical

Essential tools required for daily operations

(e.g., Shopify, payment processors, email marketing platforms)

Redundant

Overlapping tools that solve the same problem

(Do you really need a paid Trello account if your team already runs everything in ClickUp? Do you need a separate SEO tool if your agency provides one?)

Zombie

Subscriptions that haven’t been opened in the last 60 days

Rule of Thumb:

If a tool is not directly generating revenue or saving meaningful time, cancel it.

This single exercise often frees up more cash than most “growth hacks.”

CFO Shift: From Cost-Cutting to Leverage (The ROTI Metric)

Cutting expenses is only half the strategy. The goal of a Lean Tech approach is not to spend less—it’s to get more leverage per dollar.

The savings from cancelled subscriptions should not sit idle. They should be deliberately reinvested into automation.

In 2026, if you or your highest-paid employees are still manually copying data from sales channels into accounting systems, you are actively destroying margin.

Instead of asking, “Is this automation software expensive?” ask a better CFO question:

“What is its ROTI — Return on Time Invested?”

If a $50/month integration tool (such as Zapier or Make) saves your Operations Manager 10 hours of manual work each month, that tool is not an expense.

It is a high-yield asset.

CFO Action: Replace Manual Work with Automation

Strategic Action Step:

Identify the single most repetitive manual task in your business (for example: invoice processing, inventory updates, customer follow-ups).

Cancel your two least-used software subscriptions this week, and reallocate that budget to one automation or AI-driven tool that permanently eliminates that task.

This is how CFOs turn cost discipline into operational leverage.

CFO Move #3: Stop Chasing Revenue — Optimize for Contribution Margin

There is an old saying in finance that every e-commerce entrepreneur should tattoo on their arm:

“Revenue is vanity, profit is sanity, and cash is king.”

In 2026, most small businesses won’t fail because they lack demand — they will fail because they misunderstand what actually makes them money.

In the era of cheap Facebook ads and low shipping rates, you could afford to fixate on top-line revenue. As long as the sales chart was going up and to the right, you assumed you were building a profitable business. But the landscape has fundamentally changed. Rising CPAs (Cost Per Acquisition), fulfillment surcharges, and ever-increasing marketplace fees have turned that old playbook into a liability.

Today, chasing revenue without understanding your unit economics is a fast track to bankruptcy.

We see this story play out constantly:

A brand hits $1 million in sales, posts a celebratory screenshot on social media — and ends the year with less than $5,000 in the bank.

Many small business owners think they are profitable because their gross margins look healthy on paper. In reality, this mindset is one of the fastest ways to run out of cash as you scale.

If you want to see exactly how a “profitable” product can still lose money—and how CFOs analyze this difference in real life—read our in-depth breakdown of contribution margin vs gross margin.

Why Revenue Growth Without Unit Economics Is a Trap

Revenue feels good. It’s visible. It’s easy to brag about. But revenue alone tells you nothing about whether your business model is actually sustainable.

If every incremental sale drains cash, scaling doesn’t make you richer — it just makes you busier and more stressed.

That’s why CFOs don’t ask, “How fast are we growing?”

They ask, “Does each sale make the business stronger?”“

The Gross Margin Fallacy

Most businesses track Gross Margin (Sales minus Cost of Goods Sold). That metric is necessary for accounting, but it is dangerously incomplete for decision-making.

Gross Margin tells you if your product could be profitable.

Contribution Margin tells you if your business actually is.

Gross Margin ignores the very costs that scale aggressively with growth — specifically Advertising and Fulfillment.

That blind spot is where many businesses quietly bleed.

Data confirms the squeeze: According to Bank of America’s 2025 report, business costs rose by an average of 18% last year, yet owners only raised prices by 12%. This 6% gap is exactly where your profit disappears if you aren’t tracking unit economics.

What Is Contribution Margin?

Contribution Margin measures how much profit one single unit contributes toward covering your fixed costs (rent, salaries, software) after all variable costs tied to that sale are paid.

It answers the most important question in your business:

“Does selling one more unit make us richer — or just busier?”

Contribution Margin Formula (Per Unit)

Contribution Margin

= Selling Price

– (COGS + Shipping + Transaction Fees + Ad Spend per Unit)

If this number is weak or negative, growth is dangerous.

The Hidden Danger of Blended ROAS

This is where many 7-figure brands quietly bleed to death.

Many sellers rely on Blended ROAS (Total Revenue / Total Ad Spend). While useful as a high-level signal, it often masks unprofitable products behind profitable ones.

Let’s walk through a realistic example for a $50 product.

Selling Price: $50.00

COGS: –$12.00

On paper, accounting shows:

Gross Profit: $38.00 (Looks great)

Now apply the contribution filter:

- Fulfillment & Shipping: –$8.50

- Marketplace Fees (15%): –$7.50

- Ad Spend (CPA): –$20.00 (Based on a 2.5 ROAS)

Contribution Margin: $2.00

You are sourcing products, managing inventory, handling customer support, and taking operational risk — all for $2 per order.

Add a modest 5% return rate, and this product is actually losing money every time you sell it.

The Critical Metric: Break-Even ROAS

To execute this CFO move in 2026, you must know your Break-Even ROAS for every SKU.

Break-Even ROAS tells you the minimum ad performance required to make $0 profit.

Break-Even ROAS Formula:

Selling Price / (Selling Price – COGS – Fees – Shipping)

If your Break-Even ROAS is 3.0 and your ads are performing at 2.5, you are paying for the privilege of selling your product.

That is not growth. That is erosion.

Strategic Action Step: The “Kill or Cure” Audit

Stop looking at store-wide averages. They lie.

This January, export your data and calculate Contribution Margin for your top 10 best-selling products individually.

- The Winners:

High contribution margin. Scale these aggressively. - The Losers:

Negative or near-zero contribution margin. You have three choices:- Cure: Raise the price or bundle it with a high-margin product to increase AOV.

- Fix: Negotiate lower supply costs or switch to cheaper fulfillment.

- Kill: If it can’t be fixed, stop advertising immediately. Liquidate the stock and move on.

Do not scale products that don’t meaningfully contribute to your bottom line.

In 2026, volume is optional; profit is mandatory.

CFO Move #4: Master Your Cash Conversion Cycle (CCC) & Build Liquidity

Profit shows up on your income statement, but cash is what pays the bills. In 2026, the businesses that survive won’t necessarily be the most profitable on paper; they will be the ones with the most efficient Cash Conversion Cycle (CCC).

With higher interest rates and tighter credit conditions, time has become the most expensive input in your business.

If you don’t know your CCC number, you aren’t managing a business — you are just moving money around.

Why Cash, Not Profit, Determines Survival in 2026

Profit is an opinion shaped by accounting rules. Cash is reality.

You can show a healthy operating profit and still fail if your cash is tied up in inventory, stuck in payment gateways, or constantly bridging gaps with expensive short-term financing. In the current economic environment, liquidity is not a “nice-to-have” — it is the difference between control and desperation.

That is why CFOs obsess over one metric more than almost any other: the speed at which cash moves through the business.

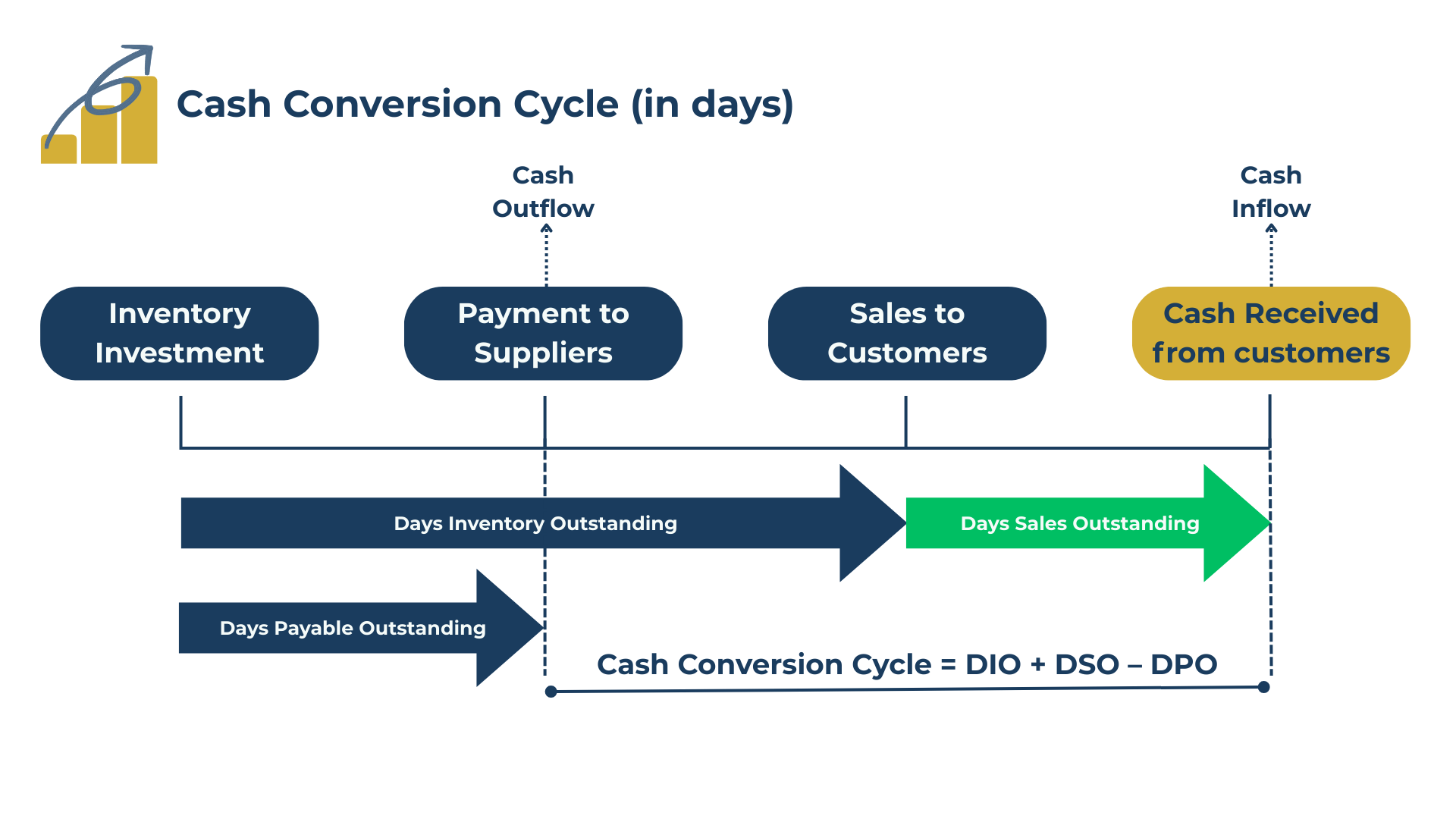

What Is the Cash Conversion Cycle (CCC)?

Simply put, the Cash Conversion Cycle measures the number of days it takes for a dollar spent on inventory to come back to you as cold, hard cash.

It captures the entire operational loop of your business — from paying suppliers, to selling products, to collecting customer payments.

The CCC Formula Explained

CCC = DIO + DSO – DPO

- DIO (Days Inventory Outstanding):

How long your inventory sits in storage before it is sold. - DSO (Days Sales Outstanding):

How long it takes to receive cash after a sale is made (including payment gateway delays). - DPO (Days Payable Outstanding):

How long you take to pay your suppliers.

Shorter cycles mean faster cash recovery. Longer cycles mean higher risk and higher financing costs.

For further explanation of CCC please visit: https://corporatefinanceinstitute.com/resources/accounting/cash-conversion-cycle/

The Hidden Link Between CCC and Operating Profit

Most entrepreneurs treat CCC as a pure “cash flow” metric. This is a mistake. Optimizing your Cash Conversion Cycle has a direct and mathematical impact on operating profit.

Here’s how:

Reduced Cost of Capital

A long CCC forces you to rely on credit lines, inventory financing, or deferred tax payments to bridge cash gaps. In a high-interest environment, these financing costs flow straight through your income statement as interest expense. Shortening your CCC reduces debt dependence — instantly improving net income.

Lower Storage and Obsolescence Costs

High DIO means you are paying to store products that are not generating cash. Amazon FBA fees, 3PL storage, insurance, and product obsolescence silently erode margins every day inventory sits unsold. Faster inventory turnover reduces these holding costs, effectively increasing operating profit without raising prices.

Why the Best Operators Aim for a Negative CCC

The “holy grail” of e-commerce finance is a negative Cash Conversion Cycle — collecting cash from customers before paying suppliers.

Amazon is the classic example: customers pay instantly, while suppliers are paid weeks or months later. This structure allows growth to be funded by operating cash instead of external financing.

While not every small business can achieve a negative CCC, every business can compress it — and even modest improvements can unlock significant liquidity.

Actionable Ways to Compress Your CCC in 2026

1. Attack DIO (Inventory Velocity)

Smaller, More Frequent Orders

Stop buying six months of inventory just to save a few cents per unit. The carrying cost of idle capital often exceeds the bulk discount. Aim for 2–3 months of stock instead.

Liquidate Ruthlessly

If a SKU hasn’t moved in 90 days, it is dead capital. Liquidate it to unlock cash — even at break-even. Cash today is more valuable than hypothetical margin tomorrow.

2. Leverage DPO (Supplier Terms)

Negotiate Terms, Not Just Price

Instead of pushing for a $0.10 unit discount, negotiate payment terms. Moving from “100% upfront” to “30% upfront, 70% Net 30” can dramatically improve liquidity.

Use Trade Credit Strategically

If suppliers won’t offer terms, explore supply chain financing or trade credit options to extend payables without damaging relationships.

3. Optimize DSO (Payout Speed)

In most e-commerce models, DSO is relatively short — but payment gateway holds, reserves, and B2B wholesale terms can quietly stretch it.

If you sell wholesale, incentivize early payment (e.g., 2% discount for payment within 10 days). Faster cash collection reduces reliance on external financing.

Strategic Action Step

Calculate your current Cash Conversion Cycle using your Q4 2025 data.

Target: Reduce it by 15 days in Q1 2026.

If your CCC is 45 days and your business generates $50,000 per month in sales, reducing it to 30 days unlocks roughly $25,000 in free cash flow — without selling a single additional unit.

That is the power of financial efficiency.

No new ads. No new products. Just better control of time and cash.

CFO Move #5: Adopt AI-Driven Financial Intelligence (Beyond Dashboards and Gut Feel)

If you are only using Artificial Intelligence to write product descriptions or customer support emails, you are using a Ferrari to deliver pizza.

In 2026, the real competitive advantage of AI will not come from content creation — it will come from financial analysis and decision support.

For most small businesses, hiring a full-time CFO or data scientist is not economically viable. But today, advanced Large Language Models (LLMs) like ChatGPT (with data analysis), Claude, or Microsoft Copilot can act as a “Junior Financial Analyst” — available 24/7 at a fraction of the cost.

The winners in 2026 won’t be the businesses that “use AI.”

They will be the ones that ask better financial questions with it.

From Excel Formulas to Pattern Recognition

Excel is a phenomenal tool — and it will remain one. But Excel only answers the questions you explicitly ask.

AI does something fundamentally different.

Instead of just calculating outputs, it can detect patterns, correlations, anomalies, and risks that are easy to miss in a spreadsheet with thousands of rows. It helps you move from reporting the past to anticipating the future.

In CFO terms, this is the shift from bookkeeping to insight.

Practical Ways to Use AI for Financial Modeling in 2026

Below are three high-leverage, low-risk ways small businesses can use AI as a financial decision engine — not a gimmick.

1. Predictive Demand Forecasting (Beyond “Last Year + 10%”)

Most small businesses still forecast demand using simplistic assumptions. This breaks down quickly in volatile markets.

Instead, you can feed anonymized historical sales data into an AI analysis tool to generate scenario-based forecasts.

Example Prompt:

“Here is my monthly sales data by SKU for the last 36 months. Considering seasonality effects in Q1 and the recent demand slowdown in Category X, generate conservative, base-case, and optimistic sales forecasts for the next quarter.”

Result:

You get a probabilistic view of the future — not a single, fragile number. This feeds directly into better inventory planning, cash forecasting, and risk management.

2. Expense Anomaly Detection (Your Automated Internal Auditor)

As businesses scale, expense leakage becomes inevitable. Humans get tired. AI doesn’t.

The Strategy:

Export your general ledger or credit card transactions as a CSV file.

Example Prompt:

“Analyze these expenses. Identify recurring subscriptions that have increased by more than 5% year-over-year, flag duplicate transactions, and highlight vendors with irregular payment patterns.”

Result:

AI functions as a tireless internal auditor, surfacing issues that would otherwise go unnoticed — especially useful during cost-cutting or efficiency drives.

3. “What-If” Scenario Planning (Where Strategy Meets Finance)

This is where AI becomes a true CFO tool.

Instead of guessing, you can stress-test decisions before committing capital.

Example Prompt:

“Run a stress test. If shipping costs increase by 15% and conversion rates drop by 0.5% in Q2, how does this impact Contribution Margin and Net Cash Flow? Build a comparison table between the current scenario and the stress scenario.”

Result:

You gain clarity on downside risk, margin sensitivity, and cash exposure — allowing you to act proactively instead of reacting under pressure.

Strategic Action Step

This week, stop treating AI as a copywriter and start treating it as a financial consultant.

Take one concrete dataset — for example, 2025 PPC spend versus net profit — upload it to a secure AI analysis environment, and ask one focused strategic question:

“What is the relationship between ad spend and net profit? At what spending level do marginal returns begin to decline?”

The insight you uncover may fundamentally reshape your 2026 budget, growth targets, and risk appetite.

In an uncertain economy, intuition is optional.

Data-driven financial intelligence is not.

Conclusion

Let’s be real for a second.

We know that reading 3,500 words about Cash Conversion Cycles and Contribution Margins probably wasn’t how you imagined spending your time when you first started your business. Most of us became entrepreneurs because we love creating products, building brands, or solving real problems — not because we love spreadsheets.

But here is the hard truth most founders learn too late:

The fun part of the business can only exist if the boring part is healthy.

The strategies in this blueprint aren’t about impressing an accountant or optimizing a dashboard. They are about control.

They are about sleeping better at night.

They are about not panicking when a supplier raises prices — and not sweating when sales dip in January — because you understand your numbers and you have a plan.

This is what real CFO-level financial management looks like.

So take a deep breath.

You don’t need to turn into a Wall Street CFO overnight.

You don’t need to implement all five moves tomorrow morning.

Just start with one.

Maybe this week you cancel three software subscriptions no one has used in months.

Maybe you calculate the real contribution margin of your best-selling product for the first time.

One small, deliberate financial decision is enough to put you ahead of 90% of businesses that are still driving with their eyes closed. In finance, consistency always beats intensity.

2026 will be a challenging year — but it will also reward the prepared.

Fix the roof while the sun is shining.

You’ve got this.

Struggling with Cash Flow Despite Growing Sales?

If your business is profitable on paper but still feels tight on cash, you’re not alone.

We work with small business owners who want clarity—not complexity.

From cash flow diagnostics to contribution margin analysis, we help you understand where the money actually goes